Steps 1-6

- Load the R packages we will use.

- Read the data in the files,

drug_cos.csv,health_cos.csvinto R and assign to the variablesdrug_cosandhealth_cos, respectively.

drug_cos <- read.csv("http://estanny.com/static/week6/drug_cos.csv")

health_cos <- read_csv("http://estanny.com/static/week6/health_cos.csv")

- Use

glimpseto get a glimpse of the data

drug_cos %>% glimpse()

Rows: 104

Columns: 9

$ ticker <chr> "ZTS", "ZTS", "ZTS", "ZTS", "ZTS", "ZTS", "Z...

$ name <chr> "Zoetis Inc", "Zoetis Inc", "Zoetis Inc", "Z...

$ location <chr> "New Jersey; U.S.A", "New Jersey; U.S.A", "N...

$ ebitdamargin <dbl> 0.149, 0.217, 0.222, 0.238, 0.182, 0.335, 0....

$ grossmargin <dbl> 0.610, 0.640, 0.634, 0.641, 0.635, 0.659, 0....

$ netmargin <dbl> 0.058, 0.101, 0.111, 0.122, 0.071, 0.168, 0....

$ ros <dbl> 0.101, 0.171, 0.176, 0.195, 0.140, 0.286, 0....

$ roe <dbl> 0.069, 0.113, 0.612, 0.465, 0.285, 0.587, 0....

$ year <int> 2011, 2012, 2013, 2014, 2015, 2016, 2017, 20...health_cos %>% glimpse()

Rows: 464

Columns: 11

$ ticker <chr> "ZTS", "ZTS", "ZTS", "ZTS", "ZTS", "ZTS", "ZT...

$ name <chr> "Zoetis Inc", "Zoetis Inc", "Zoetis Inc", "Zo...

$ revenue <dbl> 4233000000, 4336000000, 4561000000, 478500000...

$ gp <dbl> 2581000000, 2773000000, 2892000000, 306800000...

$ rnd <dbl> 427000000, 409000000, 399000000, 396000000, 3...

$ netincome <dbl> 245000000, 436000000, 504000000, 583000000, 3...

$ assets <dbl> 5711000000, 6262000000, 6558000000, 658800000...

$ liabilities <dbl> 1975000000, 2221000000, 5596000000, 525100000...

$ marketcap <dbl> NA, NA, 16345223371, 21572007994, 23860348635...

$ year <dbl> 2011, 2012, 2013, 2014, 2015, 2016, 2017, 201...

$ industry <chr> "Drug Manufacturers - Specialty & Generic", "...- Which variables are the same in both data sets

names_drug <- drug_cos %>% names()

names_health <- health_cos %>% names()

intersect(names_drug, names_health)

[1] "ticker" "name" "year" - Select subset of variables to work with

For

drug_cosselect (in this order):ticker,year,grossmargin-Extract observations for 2018

-Assign output to

drug_subset

-For health.cos select (in this order): ticker , year , revenue , gp , industry

-Extract observations for 2018

-Assign output to health_subset

- Keep all the rows and columns

drug_subsetjoin with columns inhealth_subset

drug_subset %>% left_join(health_subset)

ticker year grossmargin revenue gp

1 ZTS 2018 0.672 5825000000 3914000000

2 PRGO 2018 0.387 4731700000 1831500000

3 PFE 2018 0.790 53647000000 42399000000

4 MYL 2018 0.350 11433900000 4001600000

5 MRK 2018 0.681 42294000000 28785000000

6 LLY 2018 0.738 24555700000 18125700000

7 JNJ 2018 0.668 81581000000 54490000000

8 GILD 2018 0.781 22127000000 17274000000

9 BMY 2018 0.710 22561000000 16014000000

10 BIIB 2018 0.865 13452900000 11636600000

11 AMGN 2018 0.827 23747000000 19646000000

12 AGN 2018 0.861 15787400000 13596000000

13 ABBV 2018 0.764 32753000000 25035000000

industry

1 Drug Manufacturers - Specialty & Generic

2 Drug Manufacturers - Specialty & Generic

3 Drug Manufacturers - General

4 Drug Manufacturers - Specialty & Generic

5 Drug Manufacturers - General

6 Drug Manufacturers - General

7 Drug Manufacturers - General

8 Drug Manufacturers - General

9 Drug Manufacturers - General

10 Drug Manufacturers - General

11 Drug Manufacturers - General

12 Drug Manufacturers - General

13 Drug Manufacturers - GeneralQuestion: join_ticker

*Start with drug_cos

Extract observations for the ticker MYL from drug_cos Assign output to the variable drug_cos_subset

drug_cos_subset <- drug_cos %>%

filter(ticker == "MYL")

*Display drug_cos_subset

drug_cos_subset

ticker name location ebitdamargin grossmargin netmargin

1 MYL Mylan NV United Kingdom 0.245 0.418 0.088

2 MYL Mylan NV United Kingdom 0.244 0.428 0.094

3 MYL Mylan NV United Kingdom 0.228 0.440 0.090

4 MYL Mylan NV United Kingdom 0.242 0.457 0.120

5 MYL Mylan NV United Kingdom 0.243 0.447 0.090

6 MYL Mylan NV United Kingdom 0.190 0.424 0.043

7 MYL Mylan NV United Kingdom 0.272 0.402 0.058

8 MYL Mylan NV United Kingdom 0.258 0.350 0.031

ros roe year

1 0.161 0.146 2011

2 0.163 0.184 2012

3 0.153 0.209 2013

4 0.169 0.283 2014

5 0.133 0.089 2015

6 0.052 0.044 2016

7 0.121 0.054 2017

8 0.074 0.028 2018- Use left_join to combine the rows and columns of

drug_cos_subsetwith the columns ofhealth_cos

*Assign the output to combo_df

combo_df <- drug_cos_subset %>%

left_join(health_cos)

*Display combo_df

combo_df

ticker name location ebitdamargin grossmargin netmargin

1 MYL Mylan NV United Kingdom 0.245 0.418 0.088

2 MYL Mylan NV United Kingdom 0.244 0.428 0.094

3 MYL Mylan NV United Kingdom 0.228 0.440 0.090

4 MYL Mylan NV United Kingdom 0.242 0.457 0.120

5 MYL Mylan NV United Kingdom 0.243 0.447 0.090

6 MYL Mylan NV United Kingdom 0.190 0.424 0.043

7 MYL Mylan NV United Kingdom 0.272 0.402 0.058

8 MYL Mylan NV United Kingdom 0.258 0.350 0.031

ros roe year revenue gp rnd netincome

1 0.161 0.146 2011 6129825000 2563364000 294728000 536810000

2 0.163 0.184 2012 6796100000 2908300000 401300000 640900000

3 0.153 0.209 2013 6909100000 3040300000 507800000 623700000

4 0.169 0.283 2014 7719600000 3528000000 581800000 929400000

5 0.133 0.089 2015 9429300000 4216100000 671900000 847600000

6 0.052 0.044 2016 11076900000 4697000000 826800000 480000000

7 0.121 0.054 2017 11907700000 4783100000 783300000 696000000

8 0.074 0.028 2018 11433900000 4001600000 704500000 352500000

assets liabilities marketcap

1 11598143000 8093361000 9152949366

2 11931897000 8576069000 11186639345

3 15294800000 12334900000 16615987073

4 15820500000 12544500000 21097801310

5 22267700000 12501900000 26588761155

6 34726200000 23608600000 20414265402

7 35806300000 22498700000 22696620826

8 32734900000 20567800000 14128302853

industry

1 Drug Manufacturers - Specialty & Generic

2 Drug Manufacturers - Specialty & Generic

3 Drug Manufacturers - Specialty & Generic

4 Drug Manufacturers - Specialty & Generic

5 Drug Manufacturers - Specialty & Generic

6 Drug Manufacturers - Specialty & Generic

7 Drug Manufacturers - Specialty & Generic

8 Drug Manufacturers - Specialty & Generic- Note: the variables

ticker,name,location, andindustryare the same for all the observations

*Assign the company name to co_name

co_name <- combo_df %>%

distinct(name) %>%

pull()

*Assign the company location to co_location

co_location <- combo_df %>%

distinct(location) %>%

pull()

*Assign the industry to co_industry group

co_industry <- combo_df %>%

distinct(industry) %>%

pull()

Put the r inline commands used in the blanks below. When you knit the document the results of the commands will be displayed in your text.

The company Mylan NV is located in United Kingdom and is a member of the drug manufacturers industry group.

*Start with combo_df

*Select variables (in this order): year, grossmargin, netmargin, revenue, gp, netincome

*Assign the output to combo_df_subset

combo_df_subset <- combo_df %>%

select(year, grossmargin, netmargin,

revenue, gp, netincome)

*Display combo_df_subset

combo_df_subset

year grossmargin netmargin revenue gp netincome

1 2011 0.418 0.088 6129825000 2563364000 536810000

2 2012 0.428 0.094 6796100000 2908300000 640900000

3 2013 0.440 0.090 6909100000 3040300000 623700000

4 2014 0.457 0.120 7719600000 3528000000 929400000

5 2015 0.447 0.090 9429300000 4216100000 847600000

6 2016 0.424 0.043 11076900000 4697000000 480000000

7 2017 0.402 0.058 11907700000 4783100000 696000000

8 2018 0.350 0.031 11433900000 4001600000 352500000*Create the variable grossmargin_check to compare with the variable grossmargin. They should be equal. - grossmargin_check = gp / revenue

*Create the variable close_enough to check that the absolute value of the difference between grossmargin_check and grossmargin is less than 0.001.

combo_df_subset %>%

mutate(grossmargin_check = gp / revenue,

close_enough = abs(grossmargin_check - grossmargin) < 0.001)

year grossmargin netmargin revenue gp netincome

1 2011 0.418 0.088 6129825000 2563364000 536810000

2 2012 0.428 0.094 6796100000 2908300000 640900000

3 2013 0.440 0.090 6909100000 3040300000 623700000

4 2014 0.457 0.120 7719600000 3528000000 929400000

5 2015 0.447 0.090 9429300000 4216100000 847600000

6 2016 0.424 0.043 11076900000 4697000000 480000000

7 2017 0.402 0.058 11907700000 4783100000 696000000

8 2018 0.350 0.031 11433900000 4001600000 352500000

grossmargin_check close_enough

1 0.4181790 TRUE

2 0.4279366 TRUE

3 0.4400428 TRUE

4 0.4570185 TRUE

5 0.4471276 TRUE

6 0.4240356 TRUE

7 0.4016813 TRUE

8 0.3499768 TRUE*Create the variable netmargin_check to compare with the variable netmargin. They should be equal.

*Create the variable close_enough to check that the absolute value of the difference between netmargin_check and netmargin is less than 0.001

combo_df_subset %>%

mutate(netmargin_check = netincome / revenue,

close_enough = abs(netmargin_check - netmargin) < 0.001)

year grossmargin netmargin revenue gp netincome

1 2011 0.418 0.088 6129825000 2563364000 536810000

2 2012 0.428 0.094 6796100000 2908300000 640900000

3 2013 0.440 0.090 6909100000 3040300000 623700000

4 2014 0.457 0.120 7719600000 3528000000 929400000

5 2015 0.447 0.090 9429300000 4216100000 847600000

6 2016 0.424 0.043 11076900000 4697000000 480000000

7 2017 0.402 0.058 11907700000 4783100000 696000000

8 2018 0.350 0.031 11433900000 4001600000 352500000

netmargin_check close_enough

1 0.08757346 TRUE

2 0.09430409 TRUE

3 0.09027225 TRUE

4 0.12039484 TRUE

5 0.08989002 TRUE

6 0.04333342 TRUE

7 0.05844957 TRUE

8 0.03082938 TRUEQuestion: summarize_industry

Fill in the blanks

Put the command you use in the Rchunks in the Rmd file for this quiz

Use the health_cos data

For each industry calculate mean_grossmargin_percent = mean(gp / revenue) * 100 median_grossmargin_percent = median(gp / revenue) * 100 min_grossmargin_percent = min(gp / revenue) * 100 max_grossmargin_percent = max(gp / revenue) * 100

health_cos %>%

group_by(industry) %>%

summarize(mean_grossmargin_percent = mean(gp / revenue) * 100,

median_grossmargin_percent = median(gp / revenue) * 100,

min_grossmargin_percent = min(gp / revenue) * 100,

max_grossmargin_percent = max(gp / revenue) * 100

)

# A tibble: 9 x 5

industry mean_grossmargi~ median_grossmar~ min_grossmargin~

* <chr> <dbl> <dbl> <dbl>

1 Biotech~ 92.5 92.7 81.7

2 Diagnos~ 50.5 52.7 28.0

3 Drug Ma~ 75.4 76.4 36.8

4 Drug Ma~ 47.9 42.6 34.3

5 Healthc~ 20.5 19.6 10.0

6 Medical~ 55.9 37.4 28.1

7 Medical~ 70.8 72.0 53.2

8 Medical~ 10.4 5.38 2.49

9 Medical~ 53.9 52.8 40.5

# ... with 1 more variable: max_grossmargin_percent <dbl>- mean_grossmargin_percent for the industry Medical Devices is Answer 70.8%

- median_grossmargin_percent for the industry Medical Devices is Answer 72.0%

- min_grossmargin_percent for the industry Medical Devices is Answer 53.2%

- max_grossmargin_percent for the industry Medical Devices is Answer 84.7%

Question: inline_Ticker

Fill in the blanks

Use the health_cos data

Extract observations for the ticker BMY from

health_cosand assign to the variable health_cos_subset

health_cos_subset <- health_cos %>%

filter(ticker == "BMY")

- Display

health_cos_subset

health_cos_subset

# A tibble: 8 x 11

ticker name revenue gp rnd netincome assets liabilities

<chr> <chr> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

1 BMY Bris~ 2.12e10 1.56e10 3.84e9 3.71e9 3.30e10 17103000000

2 BMY Bris~ 1.76e10 1.30e10 3.90e9 1.96e9 3.59e10 22259000000

3 BMY Bris~ 1.64e10 1.18e10 3.73e9 2.56e9 3.86e10 23356000000

4 BMY Bris~ 1.59e10 1.19e10 4.53e9 2.00e9 3.37e10 18766000000

5 BMY Bris~ 1.66e10 1.27e10 5.92e9 1.56e9 3.17e10 17324000000

6 BMY Bris~ 1.94e10 1.45e10 5.01e9 4.46e9 3.37e10 17360000000

7 BMY Bris~ 2.08e10 1.47e10 6.48e9 1.01e9 3.36e10 21704000000

8 BMY Bris~ 2.26e10 1.60e10 6.34e9 4.92e9 3.50e10 20859000000

# ... with 3 more variables: marketcap <dbl>, year <dbl>,

# industry <chr>In the console, type

?distinct. Go to the help pane to see what distinct doesIn the console, type

?pull. Go to the help pane to see what pull does

Run the code below

health_cos_subset %>%

distinct(name) %>%

pull(name)

[1] "Bristol Myers Squibb Co"- Assign the output to co_name

co_name <- health_cos_subset %>%

distinct(name) %>%

pull(name)

You can take output from your code and include it in your text.

- The name of the company with ticker BMY is

Bristol Myers Squibb Co*

In following chuck

- Assign the company’s industry group to the variable

co_industry

co_industry <- health_cos_subset %>%

distinct(industry) %>%

pull()

This is outside the Rchunck. Put the r inline commands used in the blanks below. When you knit the document the results of the commands will be displayed in your text.

The company Bristol Myers Squibb Cois a member of the Drug Manufacturers - General group.

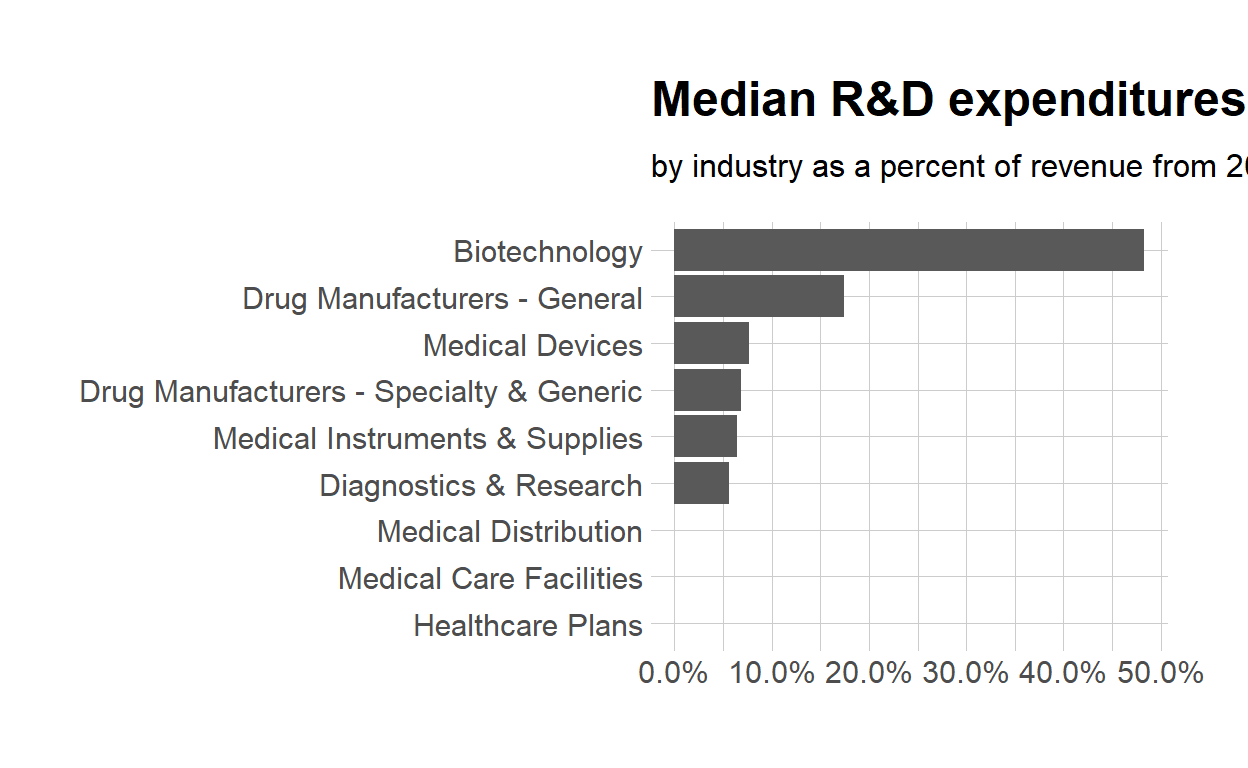

- Steps 7-11

- Prepare the data for the plots

-start with health_cos THEN -group_by industry THEN -calculate the median research and development expenditure by industry -assign the output to df

- Use

glimpseto glimpse the data for the plots.

df %>% glimpse()

Rows: 9

Columns: 2

$ industry <chr> "Biotechnology", "Diagnostics & Research", "D...

$ med_rnd_rev <dbl> 0.48317287, 0.05620271, 0.17451442, 0.0685187...- Create a static bar chart

-use ggplot to initialize the chart -data is df -the variable industry is mapped to the x-axis -reorder it based the value of med_rnd_rev -the variable med_rnd_revis mapped to the y-axis -add a bar chart using geom_col -use scale_y_continuous to label the y-axis with percent -use coord_flip() to flip the coordinates -use labs to add title, subtitle and remove x and y-axis -use theme_ipsum() from the hrbrthemes package to improve the themes

ggplot(data = df,

mapping = aes(

x = reorder(industry, med_rnd_rev),

y = med_rnd_rev

))+

geom_col()+

scale_y_continuous(labels = scales::percent)+

coord_flip()+

labs(

title = "Median R&D expenditures" ,

subtitle = "by industry as a percent of revenue from 2011 to 2018",

x = NULL, y = NULL) +

theme_ipsum()

- Save the last plot to preview.png and add to the yaml chunk at the top

ggsave(filename = "preview.png",

path = here::here("_posts", "2021-03-06-joining-data"))

- Create an interactive bar chart using the package echarts4r

-start with the data df -use arrange to reorder med_rnd_rev -use e_charts to initialize a chart -the variable industry is mapped to the x-axis -add a bar chart using e_bar with the values of med_rnd_rev -use e_flip_coords() to flip the coordinates -use e_title to add the title and the subtitle -use e_legend to remove the legends -use e_x_axis to change format of labels on x-axis to percent -use e_y_axis to remove labels on y-axis- -use e_theme to change the theme. Find more themes here

df %>%

arrange(med_rnd_rev) %>%

e_charts(

x = industry

) %>%

e_bar(

serie = med_rnd_rev,

name = "median"

) %>%

e_flip_coords() %>%

e_tooltip() %>%

e_title(

text = "Median industry R&D expenditures",

subtext = "by industry as a percent of revenue from 2011 to 2018",

left = "center") %>%

e_legend(FALSE) %>%

e_x_axis(

formatter = e_axis_formatter("percent", digits = 0)

) %>%

e_y_axis(

show = FALSE

) %>%

e_theme("infographic")